Utilizing the Tax Cuts and Jobs Act to Optimize Your Planning

The Tax Cuts and Jobs Act (TCJA) made several significant changes to individual income tax, corporate tax, partnership tax and estate tax laws for 2018 tax filings. While these changes will have varying effects depending on the taxpayer’s situation, several opportunities are presented under which beneficial tax treatment may be obtained.

Individual Income Tax

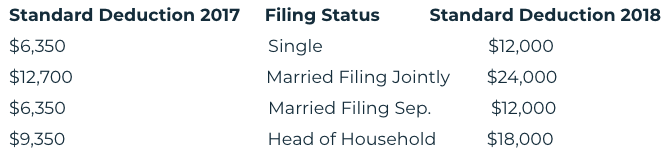

Many taxpayers who previously itemized their deductions may find it more advantageous to take the standard deduction. The TCJA nearly doubled the standard deduction, as shown in the table below:

While the increased standard deduction may reduce overall tax paid for many, others may loose deductions previously utilized. One of the most common itemized deduction is for home mortgage interest. Prior to passage of the TCJA, both acquisition indebtedness as well as home equity indebtedness were appropriate deductions. For 2018 filings, the amount of acquisition debt is limited to $750,000 for a married couple and completely eliminates any deduction for home equity debt. These new limitations will only apply to debt incurred after December 15, 2017.

A burden to many California residents will be the $10,000 limit for deductions related to state and local taxes that are unrelated to the taxpayer’s trade or business. Several estate planning techniques have emerged attempting to circumvent this limitation, including transferring partial ownership into LLC’s or other entities which may then each claim up to the $10,000 limit. Unfortunately, the IRS has proposed Section 643(f) which would prevent taxpayers from establishing multiple non-grantor trusts in order to avoid federal income tax.

The TCJA may also change how many taxpayers choose to make contributions to charity. Due to the increased standard deduction, tax benefits may be lost if the contribution is not large enough. Taxpayers should consider bundling together several years worth of previous annual contributions into one larger contribution in order to reap the tax benefits. Another consideration would be a Charitable Remainder Trust which allows individuals to contribute to charity, claim a deduction and still receive an income stream off the contribution for life. The TCJA increases the deduction limit for contributions to charitable organizations up to 60% of the donor’s contribution base for cash donations made after January 1, 2018.

Corporate and Partnership Tax

Prior to the passage of the TCJA, the highest marginal tax rate for C Corporations was set at 35%. The TCJA provides for a flat 21% tax rate on all corporate taxable income, allowing for a huge reduction in corporate tax for many corporations.

In addition to changing the corporate tax rate, the TCJA also introduced §199A, a provision permitting taxpayers to deduct a percentage of their qualified business income received as a Partner, an S Corporation shareholder or a sole proprietor. Assuming an individual’s taxable income does not exceed $157,500 and performs a non-service based business, the taxpayer may be eligible for a 20% qualified business income deduction.

The new business tax laws may increase the value of many family owned businesses dramatically. Taxpayers may therefore want to consider possible gifting strategies outlined below in order to shift wealth to the next generation without incurring estate tax.

Estate Tax

In 2017, the basic exclusion amount for estate taxes was $5,490,000. The TCJA more than doubled that amount to $11,180,000 per individual dying in 2018, and $11,400,000 for persons dying in 2019. This is the highest the estate tax exemption has ever been and may ever be. This higher exemption amount is set to sunset in 2025 back to $5,000,000 and therefore presents a true use it or loose it tax benefit. The exemption may be lowered prior to 2025 if the political climate in Washington, D.C. changes.

For clients with estates over the current exemption amounts, aggressive gifting strategies may be the best way to utilize this high exemption amount before it is lost. In addition to allowing future appreciation to grow outside of your estate, gifting may also allow for substantial valuation discounts due to lack of control and lack of marketability, allowing for assets that would be subject to estate tax to be removed from an individual’s estate.

In the case of a family limited partnership that is valued at ten million dollars, the gifting of minority membership interests may result in valuation discounts between 30-45%. Therefore, rather than gifting a 25% interest in the partnership valued at $2,500,000, the same gift would only be valued between $1,750,00 and $1,375,000 after applying valuation discounts. These gifting strategies may be spread across multiple beneficiaries and over many years in order to optimize the client’s estate.

If you would like to discuss any of the tax law or planning techniques presented with an attorney, we recommend contacting our office to schedule an appoint with one of our attorneys.

This article was written by Anne E. Rosenthal on February 12, 2019. Anne may be contacted via e- mail at aer@drobnylaw.com

This testimonial or endorsement does not constitute a guarantee, warranty or prediction regarding the outcome of your legal matter.